Orochi‘s Solution & RWA Market 2025 Surpasses $10B

November 4, 2025

4 mins read

In 2025, RWA TVL topped $10.99B. This article explores how Orochi Network’s zkDatabase, zkDA Layer, Orand, and Orocle boost trust and transparency in real estate and supply chains, shaping the future of decentralized finance.

The RWA market has surged past $10.992B in TVL in 2025, led by Maker RWA ($1.1298B), BlackRock BUIDL ($2.372B), Ethena USDtb ($1.436B), and Ondo Finance ($0.972B), per DeFiLlama. Orochi Network’s zkDatabase, zkDA Layer, Orand, and Orocle enhance trust and transparency in real estate and supply chains, tackling fraud and regulatory challenges, Orochi drives the future of decentralized finance.

Real World Assets Surpasses $10B

The Real World Asset (RWA) market has reached a significant inflection point in 2025, with its Total Value Locked (TVL) surpassing $10 billion. This milestone, positions RWA as the seventh category in the decentralized finance (DeFi) space to enter the $10 billion scale club, reflecting a surge in investor confidence and institutional adoption. Patrick Scott, development director at DeFiLlama, emphasized in recent analyses that hyper-tokenization is no longer theoretical but a reality, with the potential for bonds, stocks, and the entire financial market to move on-chain. This shift is driven by the tokenization of assets like treasury bills, real estate, and commodities, which enhance liquidity and accessibility.

He said that “Hyper-tokenization is not just a theory, it is already happening. The question is not whether more assets will be tokenized, but how fast it will scale._" _

Source: DefLlama

The top market leaders on RWA Market

Maker RWA currently controls around $1.1298 billion of TVL supported by real estate and tokenized traditional assets with 20.22% market share.

Number two on RWA Market leaders is BlackRock BUIDL, with **$2.372 billion, **which is fueled by tokenized market shares, as an indicator of institutional confidence. Ethena USDtb, which stands at $1.436 billion, has seen exponential growth, recording more than 1,000% TVL growth in the past month, demonstrating investor demand for stable, yield-generating assets.

Ondo Finance, amounting to some $0.972 billion, is also highlighted, aggregatively contributing to the industry's TVL of** $10.992** billion based on recent figures. These pioneers signal the future for the industry with treasury-backed tokens reaching $4.2 billion in Q1 2025, which marks a preference for safer assets with bearish sentiments in the crypto space.

Source: DefiLlama

The Challenges and Opportunities of RWA in 2025

The RWA market, while promising, faces significant challenges. Regulatory uncertainty remains a major barrier, particularly in markets like Mexico, where adoption is slower due to custodianship and compliance issues.

Smart contract vulnerabilities and the need for robust data integrity also pose risks, especially as assets like real estate and commodities are tokenized.

However, opportunities are substantial, with projections from TokenInsight suggesting the market could reach $50 billion by the end of** 2025,** and a Boston Consulting Group report estimating up to $16 trillion for illiquid assets by 2030. Increased liquidity, fractional ownership, and institutional participation, led by players like BlackRock and JP Morgan, underscore the sector’s growth potential, making 2025 a pivotal year.

Orochi Network’s Innovative Solutions

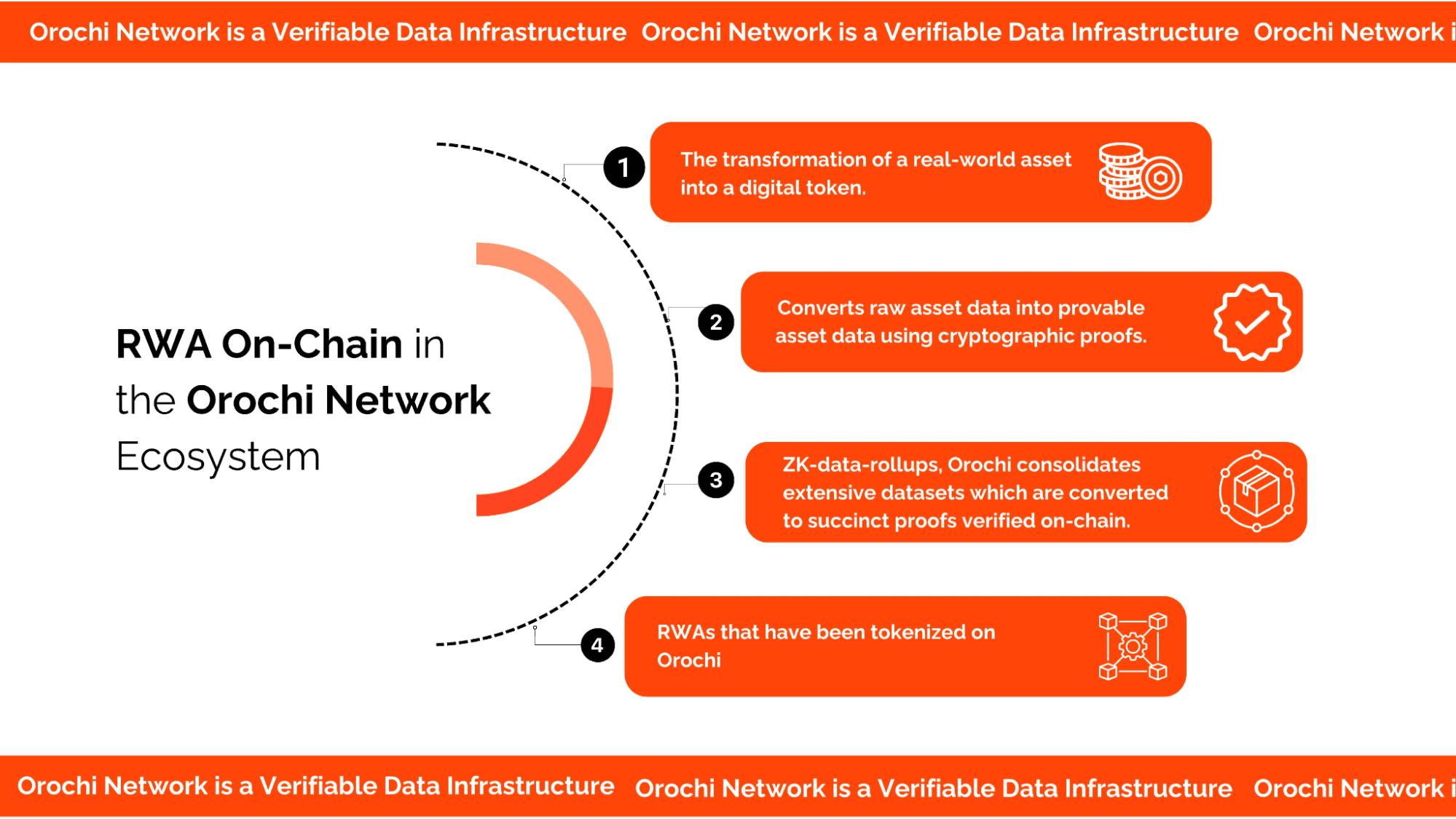

Orochi Network emerges as a key enabler, addressing RWA’s disadvantages through its suite of products. zkDatabase, powered by Zero-Knowledge Proofs (ZKPs), ensures provable data integrity, crucial for verifying ownership records in real estate.

For example, tokenized property deeds can be validated without revealing sensitive information, reducing disputes and ensuring trust, as detailed on Orochi’s official site. The zkDA Layer provides distributed data availability using a Merkle DAG off-chain system, offloading risks of single points of failure, ideal for supply chain tracking where shipment data must be verifiable and tamper-proof.

Orand offers Verifiable Randomness, ensuring fairness in processes like auction-based asset sales, while Orocle, a decentralized oracle, delivers reliable real-world data for smart contracts, enhancing transparency in logistics and trade finance. These tools enable businesses to make informed decisions with provable data, boosting customer confidence and driving growth.

In real estate, zkDatabase ensures the integrity of ownership records, preventing fraud and enabling smoother transactions. In supply chains, Orochi’s solutions reduce disputes by providing transparent tracking, enhancing operational efficiency and trust.

Conclusion and Future Outlook

The RWA market’s pump to** $10 billion **TVL in 2025 signals a transformative era for DeFi, with leaders like Maker, BlackRock, and Ethena driving adoption. While challenges like regulatory uncertainty persist, opportunities for exponential growth abound, fueled by institutional interest and technological advancements. Orochi Network’s innovations, including zkDatabase, zkDA Layer, Orand, and Orocle, position it as a vital enabler, enhancing accuracy and transparency to prevent fraud and censorship.

By ensuring provable data in critical sectors like real estate and supply chain, Orochi fosters trust and efficiency, paving the way for significant business growth and a more decentralized financial future.

Experience verifiable data in action - Join the zkDatabase live demo!

Book a Demo