Prediction markets are platforms where participants forecast future events, using collective intelligence to determine outcomes.

In recent years, the intersection of blockchain, DeFi, and advanced verifiable data technologies has transformed prediction markets from traditional betting-like systems into sophisticated, transparent, and highly secure financial instruments. Crypto prediction markets, in particular, leverage decentralization, automated settlement, and cryptographic proofs to ensure market fairness and integrity.

These platforms allow users to trade on event outcomes, from sports matches to political elections, generating a probability-based market price that reflects collective sentiment. With the rise of decentralized finance (DeFi) and blockchain-based infrastructures, prediction markets are gaining popularity as tools not only for speculation but also for enterprise-level forecasting and risk assessment.

Prediction markets are platforms where participants forecast future events, using collective intelligence to determine outcomes.

In recent years, the intersection of blockchain, DeFi, and advanced verifiable data technologies has transformed prediction markets from traditional betting-like systems into sophisticated, transparent, and highly secure financial instruments. Crypto prediction markets, in particular, leverage decentralization, automated settlement, and cryptographic proofs to ensure market fairness and integrity.

These platforms allow users to trade on event outcomes, from sports matches to political elections, generating a probability-based market price that reflects collective sentiment. With the rise of decentralized finance (DeFi) and blockchain-based infrastructures, prediction markets are gaining popularity as tools not only for speculation but also for enterprise-level forecasting and risk assessment.

What Are Prediction Markets?

At their core, prediction markets are marketplaces where individuals buy and sell contracts whose payoff depends on the outcome of future events. Unlike traditional betting, these markets aggregate information from many participants, providing a probabilistic view of likely outcomes.

For example, in a crypto prediction market, platforms like Polymarket or Limitless allow users to trade tokens representing the probability of specific events, such as a cryptocurrency reaching a certain price or a political outcome occurring.

Unlike traditional casinos, these markets aggregate collective insights from many participants to generate data-driven forecasts rather than purely entertainment-based wagers. Users can buy and sell positions on event outcomes, and the market price reflects real-time probability based on participant activity, providing a transparent and verifiable view of likely results.

This distinction makes prediction markets an increasingly important tool for enterprises and investors looking to harness crowdsourced insights. By combining market mechanics with transparent and auditable data, these platforms enable participants to make informed decisions based on real-world signals.

How Do Prediction Markets Work?

Source: X

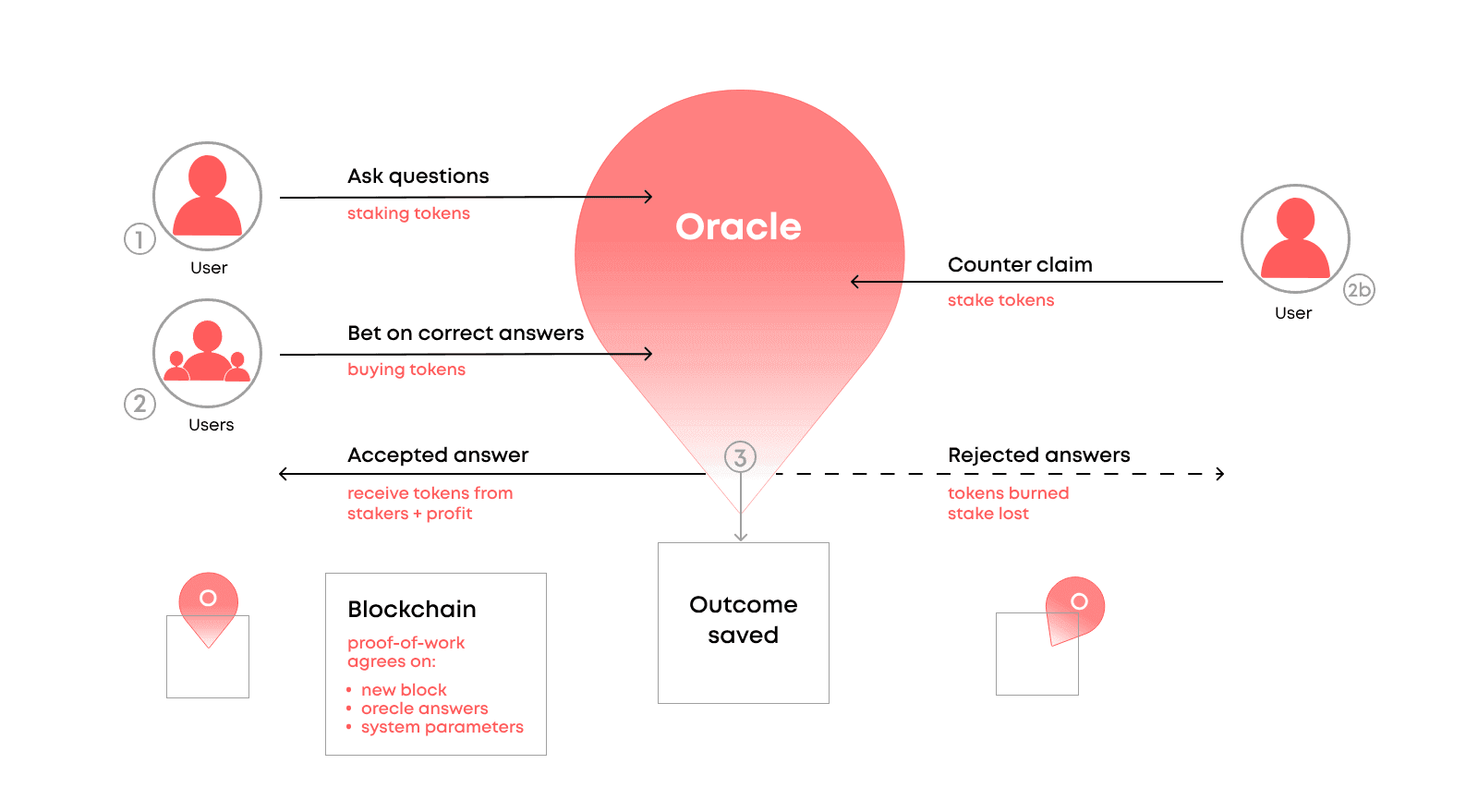

Source: XPrediction markets operate through event contracts and market scoring rules. Each contract corresponds to a specific event outcome, and the contract’s price reflects the likelihood of that outcome. Market scoring rules incentivize participants to provide truthful forecasts by adjusting prices based on supply and demand.

Liquidity in prediction markets is critical. High liquidity ensures that users can enter and exit positions efficiently, maintaining accurate price signals. In crypto prediction markets, liquidity is often provided through decentralized exchanges or liquidity pools, reducing reliance on centralized intermediaries.

Advanced technologies like zkDatabase now enable these markets to function at scale. Using ZK-data-Rollups and Zero-Knowledge Proofs, zkDatabase ensures that every trade, bet, and market operation is verifiably accurate without revealing sensitive user data. This guarantees fast, secure verification and automated contract settlement, critical for high-volume platforms.

Who Participates in Prediction Markets?

Participants in prediction markets range from traders and financial analysts to casual investors and the general public. Each participant contributes information, creating a crowdsourced forecast that reflects collective intelligence.

Behavioral studies highlight the power of crowdsourced forecasting: as more participants join, the accuracy of predictions tends to improve. Crypto and DeFi prediction markets add another layer of security and transparency, allowing users to participate without exposing sensitive data.

With zkDatabase, bets and positions can remain confidential while still being verifiable on-chain, protecting user privacy and fostering trust.

Why Are DeFi Prediction Markets Gaining Popularity?

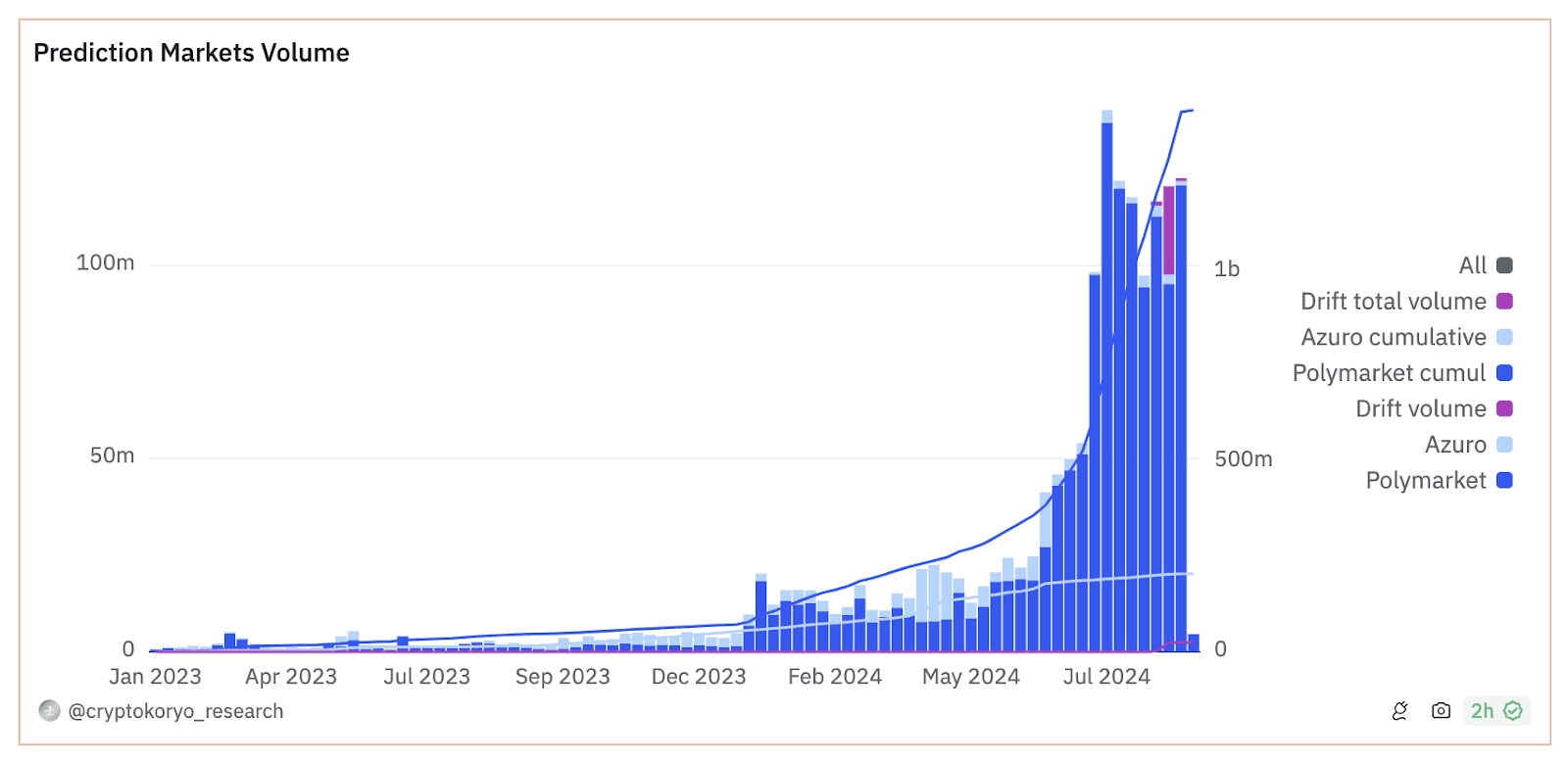

Decentralized prediction markets have surged in popularity due to their transparency, fairness, and accessibility. By removing centralized intermediaries, DeFi prediction markets allow participants worldwide to engage in forecasting, leveraging blockchain technology for trustless and automated operations.

Additionally, crypto adoption has increased the relevance of these platforms. Users can easily trade tokenized contracts and verify market outcomes through on-chain data. Technologies like zkDatabase amplify these benefits, providing efficient data verification, privacy-preserving user management, and seamless integration with smart contracts. This combination ensures fast, scalable, and auditable prediction markets that traditional platforms struggle to match.

What Are the Risks of Prediction Markets?

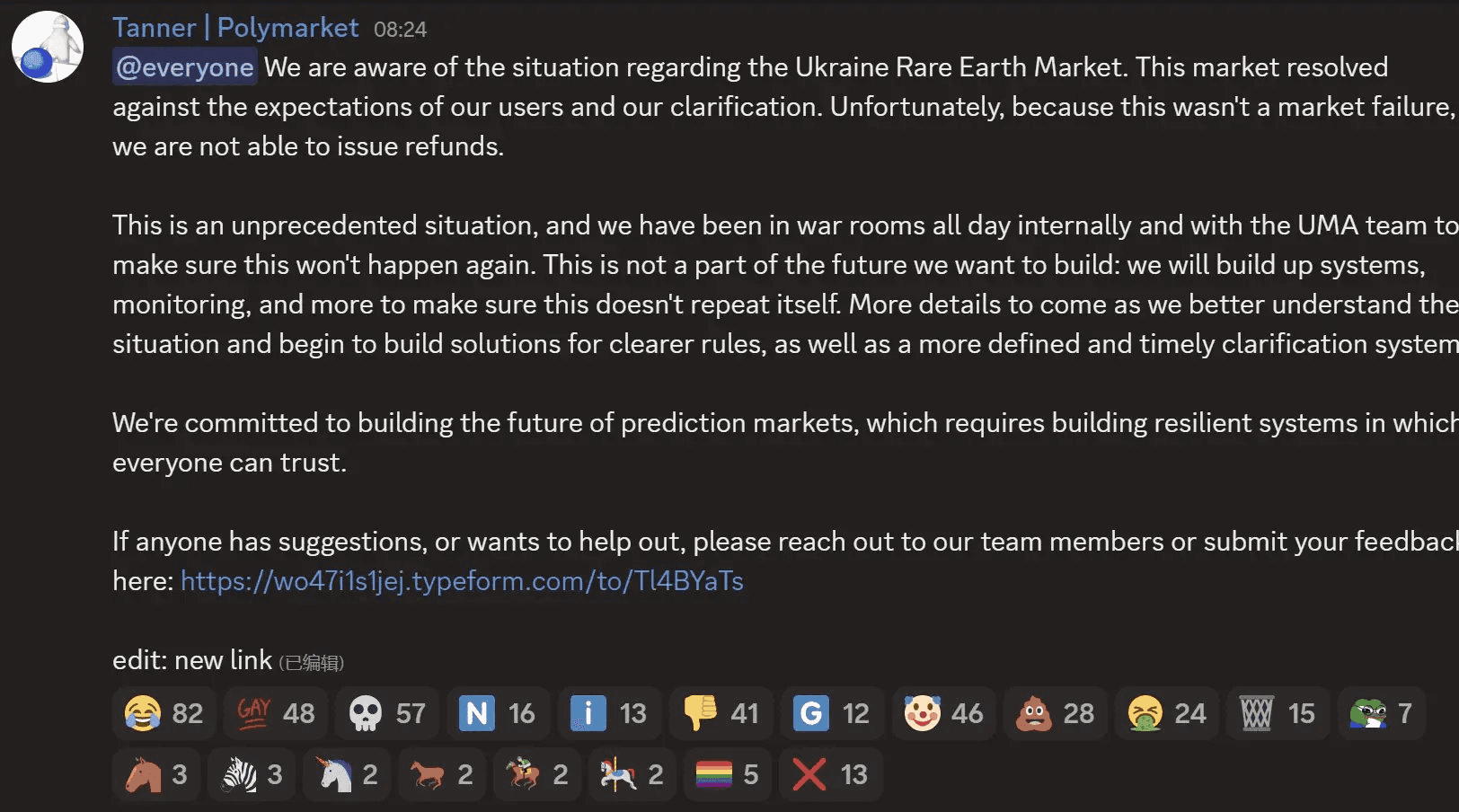

Despite technological advancements, prediction markets carry inherent risks. Market manipulation, low liquidity, and regulatory uncertainty can undermine accuracy and participant trust.

In 2025, Polymarket experienced a significant governance attack when a large holder of UMA tokens manipulated the oracle voting system to falsely settle a market regarding a U.S.-Ukraine rare earth mineral deal. This manipulation led to a $7 million dispute, as the oracle's decision did not align with the actual event outcome, raising concerns about the integrity of decentralized prediction markets.

Multiple data points can be aggregated off-chain into a single succinct proof, ensuring that even if someone attempts to manipulate the system, the verification fails.

Other issues include wash trading and arbitrage exploits. zkDatabase mitigates these problems by recording every trade operation with ZK proofs, guaranteeing that all transactions conform to market rules and remain auditable. Even under high-frequency trading scenarios, market integrity and correct sequencing are preserved.

Multiple data points can be aggregated off-chain into a single succinct proof, ensuring that even if someone attempts to manipulate the system, the verification fails.

Other issues include wash trading and arbitrage exploits. zkDatabase mitigates these problems by recording every trade operation with ZK proofs, guaranteeing that all transactions conform to market rules and remain auditable. Even under high-frequency trading scenarios, market integrity and correct sequencing are preserved.How Do Prediction Markets Differ From Traditional Betting?

While traditional betting is focused on entertainment and gambling, prediction markets are designed for accurate forecasting. Participants are incentivized to provide truthful insights, and payouts are structured around real-world outcomes rather than random chance.

Crypto prediction markets enhance this model with verifiable data, smart contract automation, and privacy-preserving mechanisms. Unlike a casino, where outcomes rely on house odds, prediction markets produce data-driven probability signals. Platforms powered by zkDatabase take this further, ensuring that all trades, odds, and settlements are cryptographically validated in milliseconds, protecting participants and preserving trust.

How Can Businesses Leverage Prediction Markets?

Enterprises and B2B organizations can harness prediction markets for strategic decision-making. These platforms allow businesses to forecast sales, market trends, and project outcomes efficiently. By tapping into collective intelligence, companies gain a competitive edge in anticipating market changes.

However, the utility of prediction markets depends heavily on data integrity. Reliable, auditable, and verifiable data is essential for making actionable business decisions.

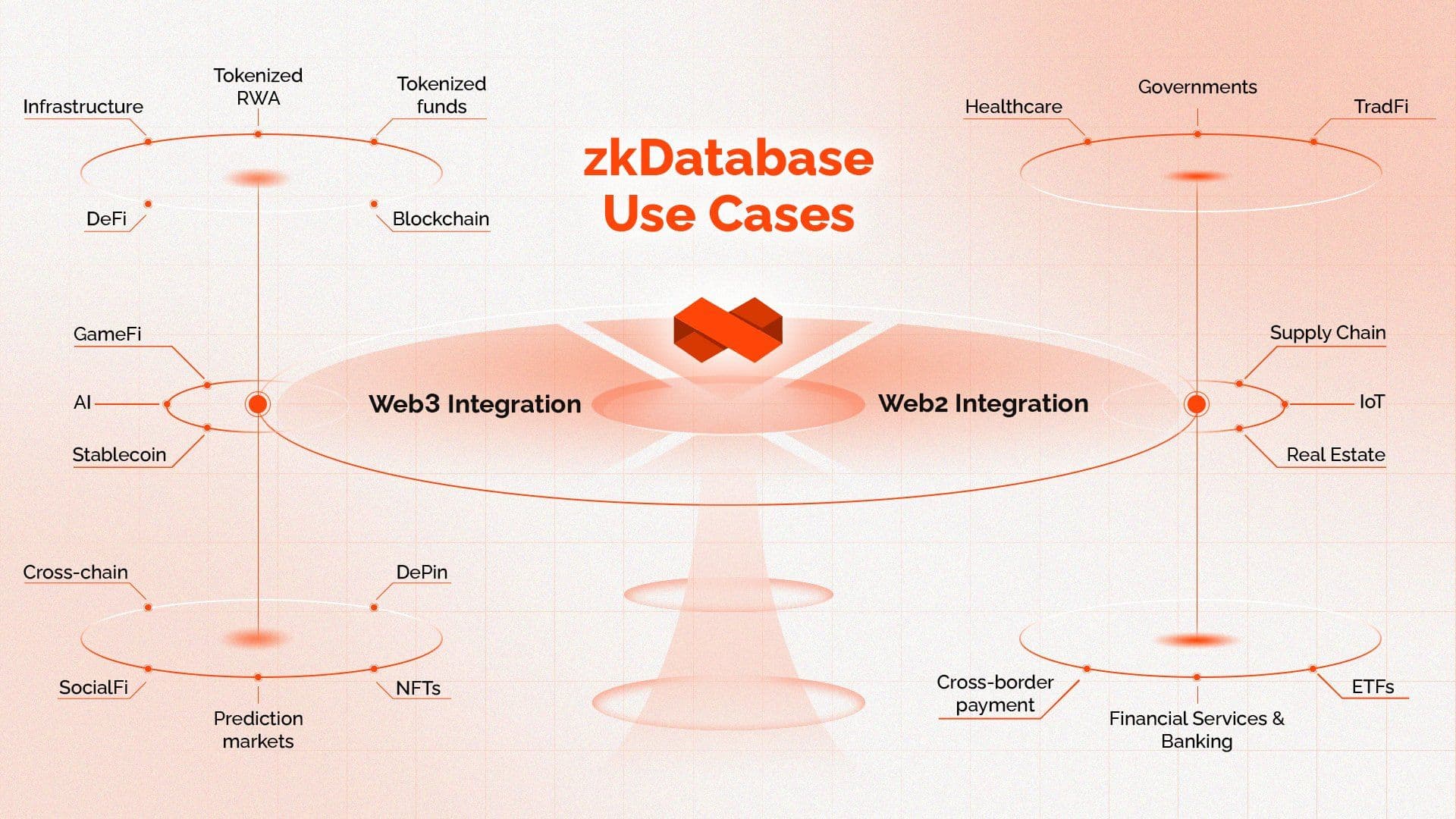

Orochi Network’s zkDatabase addresses these needs by providing fast verifiable reads and writes, privacy-preserving data handling, and seamless integration with smart contracts, ensuring prediction markets are both scalable and trustworthy for enterprise adoption.

How Orochi Network Enhances Prediction Markets

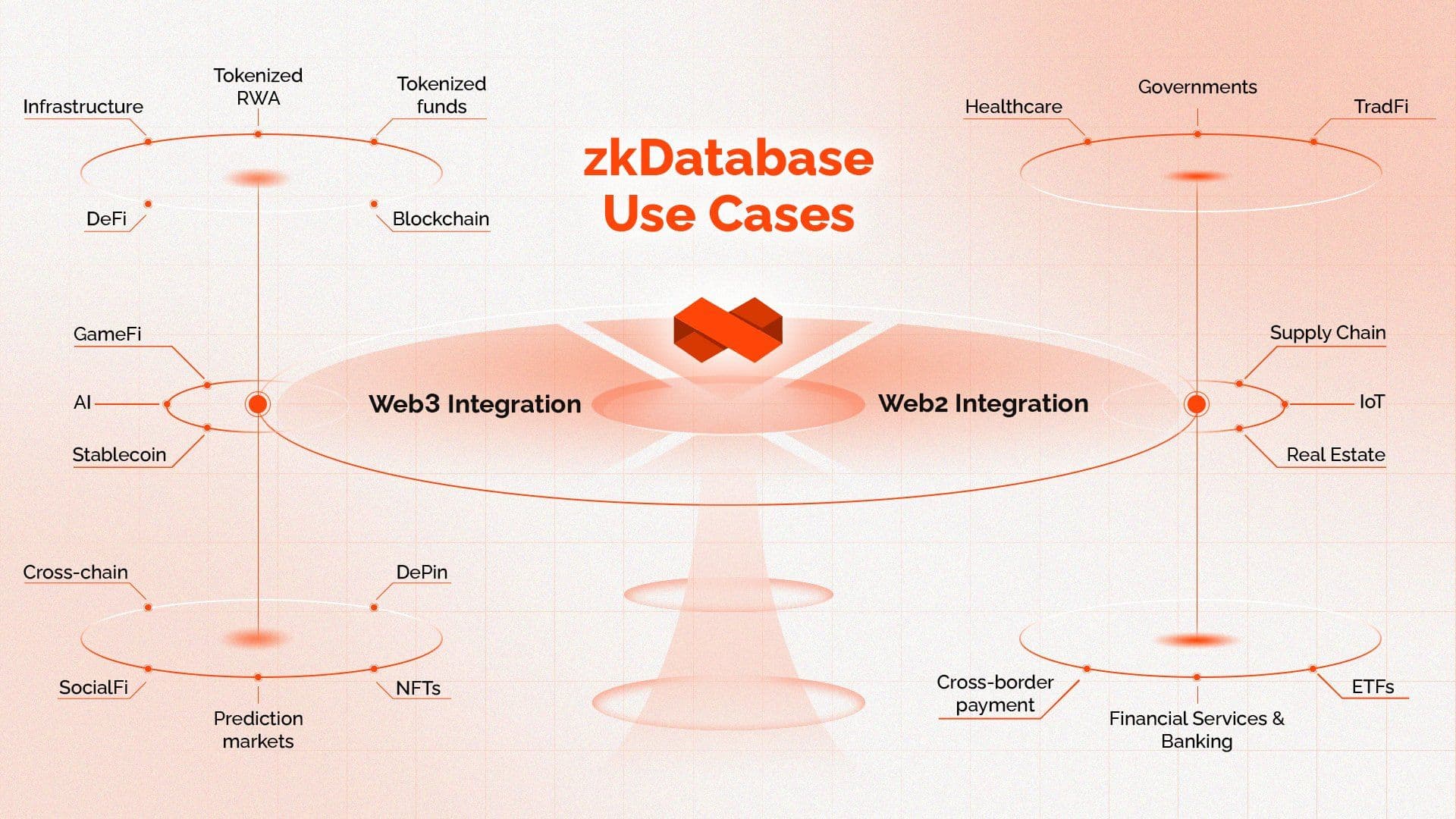

Orochi Network is Verifiable Data Infrastructure for the RWA, AI, DeFi, and more in Web3. Its advanced zkDatabase architecture guarantees that every market operation, bet, and oracle input is cryptographically verified without exposing sensitive information.

Key features include:

Key features include:

Key features include:

Key features include:- Verifiable Data Integrity: Zero-Knowledge Proofs ensure that all operations are correct, reducing fraud and manipulation.

- Privacy-Preserving User Data: User positions remain confidential while outcomes are verifiable on-chain.

- Seamless Smart Contract Integration: Platforms can read verified data directly, and Orochi’s Orocle provides cryptographic proof of real-world events.

- High Throughput & Scalability: ZK-data-Rollups allow millions of operations to be verified efficiently, even under high-volume trading scenarios.

By combining these features, Orochi Network empowers crypto prediction markets to be fast, secure, and enterprise-ready, bridging DeFi innovation with real-world applications.

Conclusion

Prediction markets are transforming the way we forecast events, combining crowdsourced intelligence, DeFi innovation, and advanced verifiable data technologies. While risks like manipulation and regulatory uncertainty exist, platforms leveraging zkDatabase and Orochi Network overcome these challenges through cryptographic verification, privacy-preserving data, and high-throughput scalability.

For businesses, B2B organizations, and crypto investors, prediction markets provide actionable insights and a reliable foundation for decision-making. With Orochi Network as a trusted Verifiable Data Infrastructure, enterprises can confidently participate in prediction markets, knowing that every transaction is auditable, accurate, and secure.

Experience verifiable data in action - Join the zkDatabase live demo!

Book a Demo