Swift building a blockchain marks a major milestone in the evolution of global financial infrastructure. The world’s largest financial messaging network, responsible for trillions in daily cross-border payments, is now exploring blockchain as a foundational layer for global settlement. It’s not just about faster payments, it’s about creating a trusted, interoperable fabric that connects traditional finance with Web3 ecosystems.

But as Swift’s blockchain project moves from concept to implementation, one truth is becoming clear: distributed ledgers alone don’t guarantee trust. The real challenge isn’t decentralization, it’s verifiability. Without a Verifiable Data Infrastructure, blockchain networks risk inheriting the same opacity and trust issues that plague existing systems.

That’s where technologies like Orochi Network’s zkDatabase come in. As the financial world shifts toward proof-based systems, zkDatabase provides the cryptographic backbone for verifiable computation, data provenance, and cross-chain trust.

Key Takeaways

-

Swift’s blockchain initiative highlights the shift from centralized trust to cryptographic verification.

-

Verifiable Data Infrastructure ensures trust, auditability, and interoperability.

-

Orochi Network’s zkDatabase provides the framework for provable data across Web3 systems.

Why Is Swift Building a Blockchain?

For decades, Swift has been the invisible infrastructure behind nearly every international transaction. It connects over 11,000 financial institutions across 200 countries. But it doesn’t move money, it moves messages. And those messages rely on trust between intermediaries.

Source: Financial Times

What Problem Is Swift Trying to Solve?

The current system works, but it’s slow and fragmented. Each transaction passes through multiple correspondent banks, each with its own ledgers and compliance rules. Settlement can take days, and reconciliation errors are costly. In an era where Visa, Ripple are experimenting with real-time settlement, Swift’s model is starting to look dated.

That’s why Swift is building a blockchain. Tokenized assets, central bank digital currencies (CBDCs), and cross-chain settlement require a common infrastructure that’s programmable, transparent, and interoperable. A blockchain backbone can synchronize data between participants without relying on bilateral trust.

But this introduces a new problem, how do you verify that the data written to the blockchain is correct in the first place?

Why Data Integrity Becomes the Core Challenge

When every institution, regulator, and system node relies on shared data, the smallest inconsistency can cascade into massive financial risk. It’s not enough to distribute data; that data must be verifiable. Swift’s blockchain will need to prove that every message, transaction, and update is cryptographically sound and tamper-proof.

This is where Verifiable Data Infrastructure becomes essential. It transforms blockchain from a messaging ledger into a provable data system, one where every state change, input, and output can be independently verified without revealing sensitive information.

What Is Verifiable Data Infrastructure?

Verifiable Data Infrastructure refers to a new generation of data systems designed to guarantee that data is accurate, untampered, and can be independently verified, without relying on a central authority. This is achieved through advanced cryptographic techniques, most notably Zero-Knowledge Proofs (ZKP) and Multi-Party Computation (MPC).

Orochi’s Verifiable Data Infrastructure is built on a robust and modular architecture:

-

**ZK-data-rollups: **Aggregate and compress large volumes of proof-carrying data, minimizing on-chain storage costs while maximizing verifiability.

-

**Merkle DAG Storage: **Utilizes Merkle Directed Acyclic Graphs for tamper-evident, efficient, and scalable data storage.

-

**Hybrid aBFT Consensus: **Achieves fast, resilient agreement on data states using asynchronous Byzantine Fault Tolerance, protecting against malicious actors and network disruptions.

-

Data Pipelines: Streamline the ingestion, transformation, and publication of proofs for real-time and historical data.

Why Legacy Data Systems Can’t Support Swift’s Blockchain

Traditional databases rely on centralized trust. You can read, write, and audit data, but you can’t mathematically prove it hasn’t been tampered with. Even when linked to blockchains, these systems become weak points, data or computations must still be “trusted” at the point of entry.

Financial networks, especially those bridging TradFi and Web3, can’t afford that risk. They require proof-carrying data, information that includes its own cryptographic verification of origin and correctness. Without this, interoperability becomes fragile, and compliance auditing remains manual and error-prone.

This is why Swift, building a blockchain, must go hand-in-hand with adopting verifiable data infrastructure. A blockchain is only as trustworthy as the data it holds.

How zkDatabase Powers Verifiable Data Infrastructure

What Is zkDatabase?

zkDatabase is a pioneering Zero-Knowledge Database (zkDatabase) solution from Orochi Network, integrating modern database architecture with advanced cryptographic techniques. It leverages Zero-Knowledge Proofs (ZKP), particularly zkSNARKs, to enable data queries and transactions to be proved without revealing the underlying data. This is achieved through a Zero-Knowledge Circuit, ensuring cryptographic verification of all data transactions.

Proof Carrying Data The initial version is built on the o1js framework from O1 Labs, with plans to support Plonky3 for faster proof generation and improved scalability. This modular architecture ensures flexibility and compatibility with decentralized applications (dApps), making it a cornerstone for Web3 data management. The database supports noSQL data structure, includes collections, documents, and ZK Circuit for proof generation and aggregation. As noted in the introduction documentation, this design aims to minimize overhead, ensuring high performance while maintaining privacy and integrity.

How zkDatabase Aligns With Swift’s Blockchain Vision

Swift’s vision of global blockchain interoperability depends on the ability to validate message flows, settlements, and compliance proofs between heterogeneous networks. zkDatabase provides exactly that foundation.

Imagine a cross-border transaction between two banks in different jurisdictions. Each bank processes its local leg of the transaction and publishes a zero-knowledge proof showing that the operation followed Swift’s rules and matched its ledger state. Swift’s blockchain aggregates these proofs, creating a verifiable chain of custody from origin to settlement, no intermediaries, no blind trust.

This approach scales beyond payments. It can extend to liquidity management, KYC compliance, and even tokenized asset reconciliation. zkDatabase makes it possible to verify global financial data without revealing proprietary or regulated information.

In other words, zkDatabase doesn’t just make Swift’s blockchain faster, it makes it verifiable.

Why Orochi Network Leads in Verifiable Data Infrastructure

What Makes Orochi Network Unique

Orochi Network is more than a product, it’s a protocol layer designed to make Web3 data verifiable, scalable, and interoperable. Its core mission is to turn “trust” into “proof” through cryptographic computation.

Where most blockchain infrastructure focuses on consensus, Orochi focuses on data validity. zkDatabase, its flagship technology, integrates both on-chain and off-chain systems, allowing enterprises and Web3 platforms to build verifiable data workflows without replacing existing infrastructure.

Orochi’s modular ZKP backend allows developers to plug in custom proof systems, Groth16, PlonK, Halo2, depending on their performance and security needs. This flexibility is essential for financial institutions like Swift, where compliance requirements and latency thresholds vary across jurisdictions.

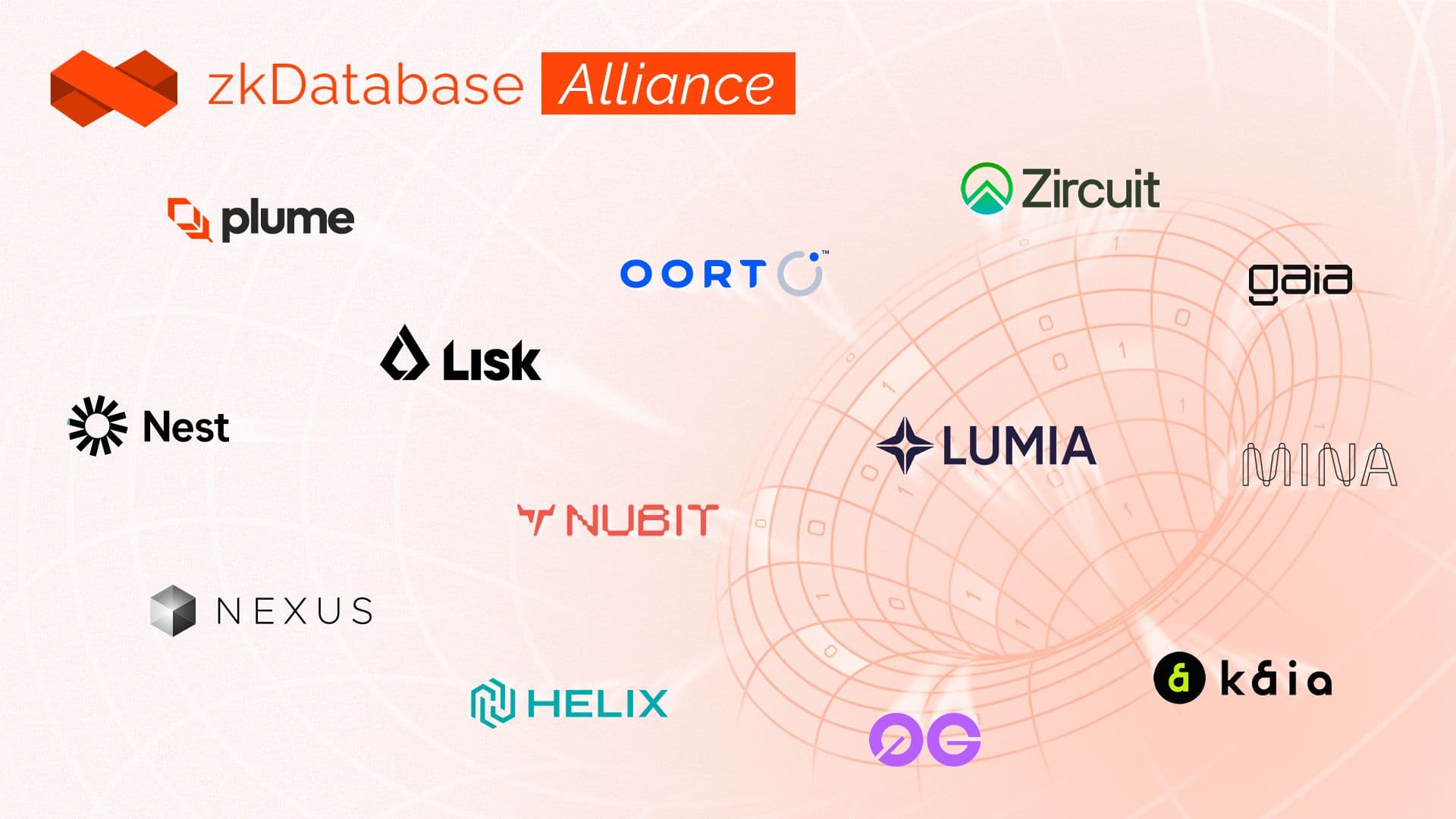

Through its zkDatabase Alliance and interoperability roadmap, Orochi Network is standardizing how verifiable data infrastructure can plug into existing financial ecosystems, from central banks to DeFi protocols.

Use Cases

While Swift’s blockchain project is the most visible example, the implications of verifiable data infrastructure reach far beyond interbank messaging.

-

RWA Tokenization: As Real-World Assets move on-chain, verifiable data is required to prove asset ownership, valuation, and compliance in real time. zkDatabase provides proof-of-asset provenance without exposing private data.

-

**Verifiable AI Data Pipelines: **AI models increasingly rely on sensitive or regulated datasets. zkDatabase allows institutions to verify training data integrity and provenance, ensuring transparency without compromising privacy.

-

Compliance and Auditing for DeFi: Financial regulators can verify that DeFi protocols adhere to compliance rules through zero-knowledge proofs, eliminating the need for intrusive audits or third-party attestations.

In all of these examples, Orochi Network’s zkDatabase transforms static data into verifiable, living proof systems, precisely what modern finance demands.

What Are the Implications of Swift’s Blockchain for Web3?

Can Verifiable Data Enable Institutional-Grade Blockchain?

For blockchain to achieve institutional adoption, it must move beyond decentralization into verifiability. Institutions like Swift, Visa, and Ripple aren’t interested in ideology; they need guaranteed correctness, compliance, and auditability.

Verifiable data infrastructure achieves this. It allows smart contracts and payment rails to interact with off-chain systems confidently. A zero-knowledge architecture ensures that every computation can be mathematically proven, reducing the need for reconciliation and manual auditing.

When reconciliation costs drop, trust increases. Swift’s blockchain initiative, powered by verifiable data, could save the financial industry billions by eliminating the redundant layers of checking and confirming that exist today.

How Will Verifiable Data Infrastructure Shape the Next Financial Internet?

The internet of finance is shifting from “trust-based messaging” to “proof-based execution.” Swift’s blockchain is an early step in this direction. Once verifiable data becomes the default, financial institutions can transact globally with instant assurance of correctness.

This change enables true blockchain interoperability. Imagine Swift communicating with Visa’s settlement network, Ripple’s liquidity bridge, data oracles, all through verifiable proofs rather than ad hoc API integrations. zkDatabase provides the common cryptographic language that makes such interoperability possible.

Long-term, verifiable data infrastructure will merge financial data, smart contracts, and AI into a unified proof-driven ecosystem. In this world, compliance is automated, auditing is continuous, and data provenance in blockchain systems becomes standard practice. Orochi Network is already building this foundation, one proof at a time.

Conclusion

Swift, building a blockchain, reveals why Verifiable Data Infrastructure is essential for the next generation of finance. As financial networks transition from message-passing to proof-based architectures, the integrity of every byte of data becomes critical. Without verifiable systems, the blockchain era risks repeating the same trust issues it set out to solve.

Orochi Network’s zkDatabase provides the practical path forward. It turns financial data into verifiable proofs, ensuring that every message, transaction, and computation in Swift’s blockchain, or any other, is cryptographically sound. The result is a new standard of data trust: scalable, auditable, and interoperable across Web3 and traditional finance. In this emerging financial internet, trust isn’t assumed, it’s proven. Swift’s blockchain may set the stage, but verifiable data infrastructure will define the future.

Experience verifiable data in action - Join the zkDatabase live demo!

Book a Demo